Carbon footprint

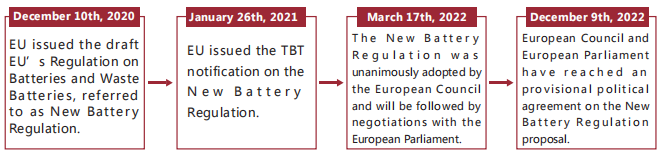

Background and process of the EU’s “New Battery Regulation”

EU’s Regulation on Batteries and Waste Batteries, also known as the EU’s New Battery Regulation, was proposed by the EU in December 2020 to gradually repeal Directive 2006/66/EC, amend Regulation (EU) No 2019/1020, and update EU battery legislation.

The current battery Directive (2006/66/EC), published in 2006, mainly sets limits on the limiting value and marking of harmful substances (mercury, cadmium and lead) contained in batteries placed on the EU market, but does not specify other performance indicators at the stage of battery production, use and recycling. The New Battery Regulation makes up for this shortfall, proposing a series of requirements for more sustainable, recyclable and safe batteries, including carbon footprint rules, minimum recycling content, performance and durability standards, and so on. The addition of carbon footprint in this battery regulation amendment has attracted particular attention from manufacturers. Recently, MCM has received a large number of inquiries related to this, so we edit and analyze the content and requirements of carbon footprint here for your reference.

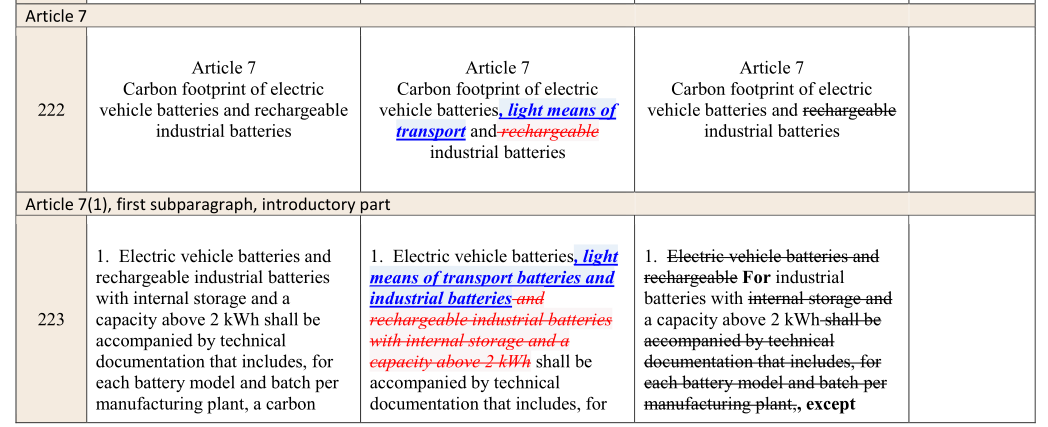

Requirements for carbon footprint

Chapter 7 of the New Battery Regulation is about the carbon footprint requirements for electric vehicle batteries, light vehicles and industrial batteries. Electric vehicle batteries and rechargeable industrial batteries with a capacity of more than 2kWh should be accompanied by technical documents. Each battery model and each manufacturing plant batch should have a carbon footprint statement, including:

(a) Information about the manufacturer;

(b) Documents on the type of battery to which the declaration applies;

(c) Information on the geographical location of battery production facilities;

(d) The carbon footprint of the battery life cycle is in kilograms of CO2 equivalent;

(e) The carbon footprint of the battery at each stage of its life cycle;

(f) The identification number of the battery’s EU declaration of conformity

The calculation method of carbon footprint

The calculation methods of carbon footprint are given in Appendix II of the New Battery Regulation. There are three types:

1) Product Environmental Footprint (PEF)

https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32013H0179&from=EN

2) Product Environmental Footprint Category Rules (PEFCRs)

https://green-business.ec.europa.eu/environmental-footprint-methods_en

3) International agreements and technical advances in the field of life cycle assessment

The calculation of the life cycle carbon footprint should be based on the bill of materials, energy and auxiliary materials used to produce a particular type of battery at a particular plant. In particular, electronic components (such as battery management units, safety units) and positive electrode materials are major contributors to the carbon footprint of batteries. The carbon footprint statement should be for the type of battery produced at a specific production site. Changes in the material list or energy mix used require a new calculation of the carbon footprint of the battery model.

Carbon footprint performance rating

Based on the distribution of the carbon footprint declared value of the battery in the market, the carbon footprint performance rating will be determined to achieve market differentiation. Category A is the best category with the lowest carbon footprint life-cycle impact. The Commission will determine the maximum life-cycle carbon footprint threshold for industrial batteries with a capacity of more than 2kWh based on the performance rating. By then, batteries that exceed the carbon footprint threshold may not be exported to the EU.

Carbon footprint implementation date

² From July 1, 2024, electric vehicle batteries, light transport vehicle batteries and industrial batteries will be required to declare their carbon footprints;

² From January 1, 2025, electric vehicle batteries, light transport vehicle batteries and industrial batteries will require carbon footprint performance rating;

(The European Commission will publish the rating method by 31 December 2024)

² From July 1, 2027, electric vehicle batteries, light transport vehicle batteries and industrial batteries with energy above 2kWh will be required to have a maximum life-cycle carbon footprint threshold.

(The European Commission will issue a carbon footprint threshold by July 1, 2025)

Carbon tariff

Brief introduction

Carbon Border Adjustment Mechanism (CBAM) is a special tariff on carbon dioxide emissions on imported products, also known as the carbon border adjustment tax. In 2021, in order to achieve the goal of reducing carbon emissions by 55% by 2030, the EU introduced Fit for 55, a series of draft legislation including carbon tariffs.

Scope of application

CBAM covers the fields of steel, cement, fertilizer, aluminum and electricity, chemicals (hydrogen, ammonia, ammonia water) and polymers (plastic products). Some countries or regions are exempted from relevant taxes, mainly including non-EU countries or regions that have joined the EU emissions trading system, or countries and regions that have mutually recognized the EU emissions trading system, but excluding China.

Subject of taxation

The tax subject of CBAM is the importer in the EU. Importers are required to register with the EU CBAM administrative authority and can import relevant products only after approval. The following is the cost calculation formula:

CBAM fees = carbon price per unit (EUR/ton) x carbon emission (ton)

Carbon emission (tons)= carbon emission intensity × product quantity (tons)

Transitional period

CBAM will start trial operation in October this year. The period from 2023 to 2026 will be the transitional trial operation stage of CBAM. During the transition period, EU importers will only need to submit quarterly emissions data (information on the total volume of imported products in the quarter, direct and indirect carbon emissions of imported products, carbon emission costs paid by imported products in the country of origin, etc.) and will not be required to pay carbon tariffs on imported products. From 2027 onwards, EU importers will be required to submit a corresponding amount of CBAM electronic credentials, that is, carbon tariffs will be imposed.

Notes: 1. Direct carbon emissions: The emission of a product during production under the direct control of the producer.

2. Indirect carbon emissions: The emissions caused by the electricity consumption during the production of the product.

EU CBAM uses the whole life-cycle method to measure carbon emissions. If an enterprise cannot accurately calculate, the default carbon emission intensity is the average carbon emission intensity of the lowest carbon emission performance (bottom 10%) of the enterprises producing the same type of products in the exporting country. If the company does not provide data on carbon emissions, the average carbon intensity of the lowest carbon emission performers (bottom 5%) of the enterprises producing the same type of products in the EU will be used.

Conclusion

The carbon footprint runs through the entire life cycle of the battery, involving raw materials, production, supply chain, application and recycling. The EU’s New Battery Regulation and carbon tariffs pay special attention to the carbon emissions of products, and make more stringent and clear requirements for battery carbon footprint declarations, performance rating and thresholds, and recycled materials. At present, China’s battery industry has no mature carbon footprint accounting standards and methods, and the battery carbon footprint data is basically blank. Whether it is the early carbon footprint data declaration, or the subsequent carbon footprint rating and threshold regulations will bring great challenges to the product sales price and export. Now there are some domestic battery companies have launched zero-carbon products, zero-carbon stores, zero-carbon factories. Other companies also need to timely understand and to meet the requirements of EU regulations as soon as possible, to ensure that the export of batteries and other products to the EU comply with the regulations.

The next monthly will bring you an interpretation of the recyclable components of batteries in Chapter 8 of EU’s New Battery Regulation: portable batteries, light transport batteries, industrial batteries, electric vehicle batteries and automotive batteries.

Post time: Jul-08-2023